Mind the Gap

A powerful set of systemic factors are threatening to bring chaos unseen in centuries to the shores of the United Kingdom

Correction: later in this essay I state that the UK state pension is for ‘state employees.’ It turns out that the state pension actually refers to the general pension for everyone in the United Kingdom. I’m fairly certain I read this at some point but just decided that it couldn’t possibly be the case and retconned it as only government employees. Just a slight technical error.

Something is very wrong in the UK.

For many years now, the Isles have been the butt of many jokes on social media. Internet commentators have made fun of TV licenses, restrictions on kitchen knife sales, and a general political ecosystem that is dramatically bizarre, even when compared to the rest of the west. “You got a loicense for that mate?” Has been making the rounds as a meme since I achieved internet literacy about a decade ago. The UK is (or was) widely understood as a stand-in for the ultimate nanny state, a kind of laughable caricature of what the government would be like if it was ran by your neurotic mother-in-law.

In the past few years, however, this kind of parochial reputation has fallen to the wayside as a far darker, more ominous picture of the United Kingdom has taken shape. ‘The Yookay’ (coined, I believe, by Mythoyookay) has come to describe, in all its bizarre and misshapen glory, the haunting aesthetics replacement migration has introduced to the quintessential and quaint England that many had in their heads. Meanwhile, the work of men like Adam Wren to uncover and catalogue the insanity of the grooming gang situation and the seemingly still ongoing cover-up surrounding it, has darkened the reputation of the entire nation to all who learn about it. ‘Adventure travel’ Youtubers like Bald and Bankrupt have gone as far as to film themselves ‘exploring’ the impoverished slums of Northern England - revealing scenes that seem reminiscent of '“a collapsing civilization” as one Youtube commenter put it.

These things are just the tip of the iceberg, however. Beneath the surface, the United Kingdom is rapidly heading towards a grand and brutal reckoning. The political class in Westminster (and particularly the administerial bureaucrats in Whitehall) have run the country into the ground. Political incentives all align against any real fixes being made. The bizarre ideologues of mass immigration keep the endless inflows coming, all while the social welfare budget becomes bloats like a corpse in water. All the while, on the horizon, the specter of something even more dangerous hovers - with protests, riots, and terrorism carried out by both the anti-immigration right and the pro-Palestine/Islamic left now a weekly, if not daily, occurrence.

At numerous levels, the United Kingdom is undergoing severe stress-testing that now threatens to sink the entire enterprise entirely. Fiscally, the state is broke and the economy has been thrown into chaos by a series of insane court-mandated rules. Socially, the nation’s understanding of itself has been shattered through a combination of immigration and extreme bifurcation of opportunity between the general area surrounding the City of London and the rest of the nation. Politically, the people now search for a solution that does not appear to be coming as the political class grows more sclerotic, not less, in the face of all these challenges.

The Fiscal Angle

The United Kingdom has some of the nuttiest benefits handouts in the entire world, full stop.

Let’s start with their state pensions: the pension given out to state workers is protected under what is called the triple-lock. This is a ‘triplicate’ set of rules that determine how much the state pension handouts rise each year. Every year, state pension benefits checks (i.e. the amount of money a former government employee receives each month from their pension) rise according to the highest of the following: inflation measured via CPI, average earnings growth across the entire UK workforce, or 2.5%.

In other words, if the UK was completely ‘stagnant’ with 0 inflation, 0 GDP growth, and 0 changes in wages for the employed, state pension checks would still rise 2.5% every single year.

This is (pretty obviously, in my opinion) a bad idea that promises fiscal unsustainability. But compared to the rest of the UK’s welfare state it is actually highly reasonable! Let me run through some of the other genius ways the UK has decided to throw benefits at its citizens:

Motability. Oh Motability. This is a massive benefits scheme where claimants of disability in the UK can lease a car by basically signing away the rights to the ‘mobility’ portion of their disability check (called PIP, Personal Independence Payment, in the UK). If this sounds bizarre it’s because it is.

Speaking of disability benefits, the UK has some of the most lucrative and extensive ones imaginable (even ignoring the basically free cars). A wonderful anecdote here about an ‘ADHD’ person who has managed to

bilkreceive support from the state to build a rather extensive home office.Of course, few things can be considered more insane than the London social housing scandal which played out over the last few years: half of all social housing in London is ‘headed’ by someone who was born overseas; a massive handout when you consider the price of housing in London for hardworking adults who actually make the UK economy work!

I could go on. I could discuss the NHS, which is a black-hole money pit with some of the worst dollar-per-dollar outcomes when compared to peer socialized healthcare systems. I could point at the endless quantity of money the state is willing to pony up to house migrants. I could point to the Chancellor of the Exchequer (head of the treasury in Bongland) literally weeping during a heated Parliamentary session around proposed budget cuts, but point is that the UK budget is trashed, with massive waste manifest everywhere, leading to a budget deficit of ~$202 billion in FYE 2025 (much more than originally planned).

Now - this stuff wouldn’t necessarily be a death knell if the UK state could ensure a growing economy. After all, isn’t the point of all this demand-side subsidy supposed to be Keynesianism and GDP growth or whatever?

Perhaps it could be if the state could find a way to stop shooting itself in the foot in a variety of increasingly insane ways.

To start with, an exodus of wealthy individuals has now become a serious issue. High taxes, economic uncertainty, and generally decreasing quality of life has seriously challenged the UK’s former reputation as a vaunted destination for the rich. Wealthy individuals leaving not only cuts into the tax base, it also cuts into the services sector. Most importantly, however, on a long-enough time span it disrupts the ‘network effects’ that draw and keep wealthy individuals and companies in specific geographic locations. It is this network effect that is the very core of London - which underpins the UK economy as a whole.

On top of this, recent court rulings on ‘gender equal pay’ have thrown the entire base-level service sector of the economy into disarray. UK courts have decided that ‘equal pay for equal work’ is now a core impetus of the state, and that only they (not the market) have the ability to decide what exactly ‘equal work’ is. This has led to a recent insane case in which it was decided that supermarket cashiers must make the same salary as warehouse workers (and receive back pay for when this was not the case). This same precedent is now actively driving councils (local government) bankrupt and has led to a whole set of insane second-order consequences, as the state arbitrating private-sector salaries predictably would. I recommend reading this thread for further information.

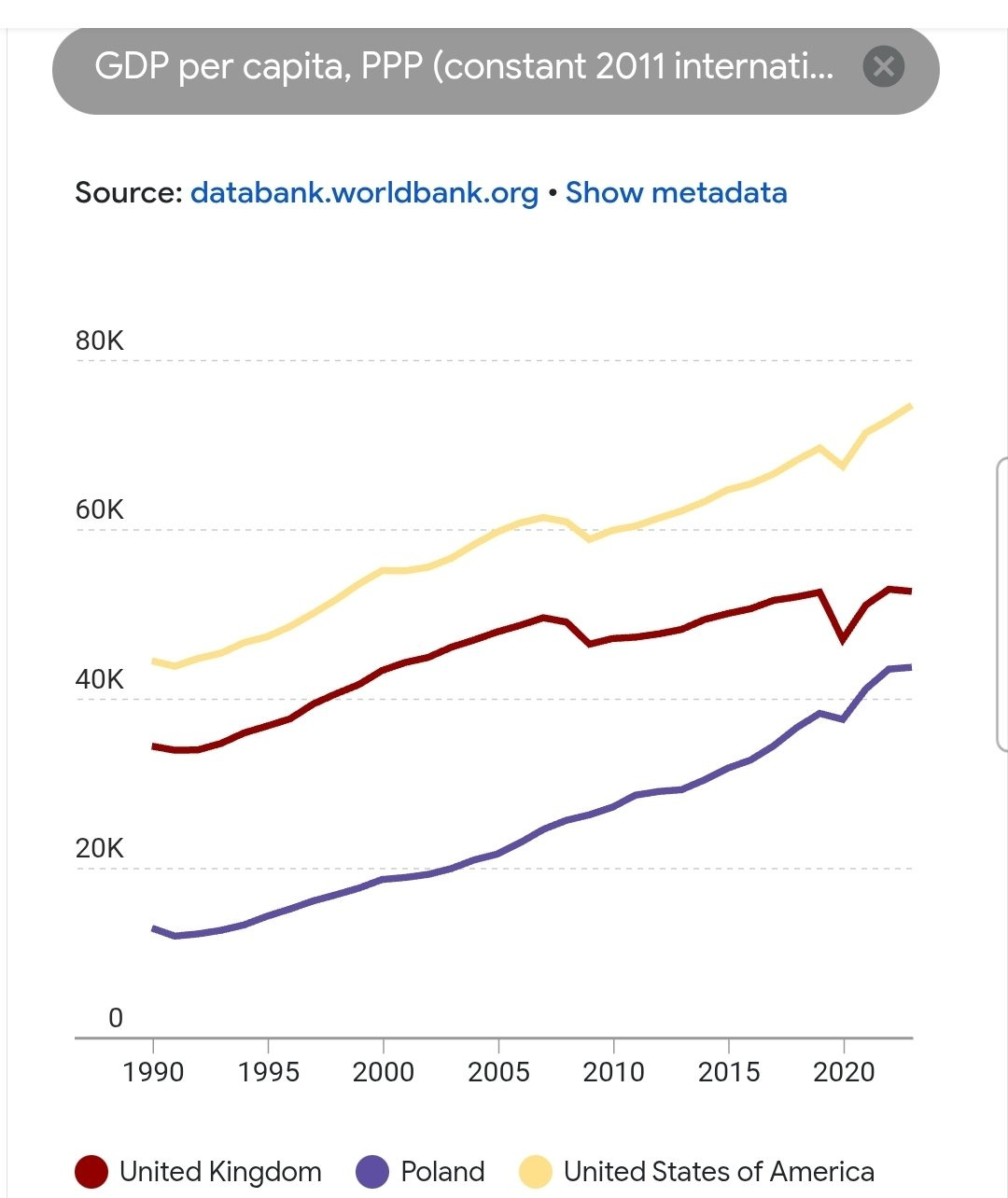

There are a whole set of other economic issues at play here. Mass immigration acting as a replacement for actual capex and productivity increases in one - but the point is this: the UK economy is effectively stagnant, and there is little or no plan to resolve underlying systemic factors (high taxes, insane legal issues, NIMBYism) that are setting it back.

There is one more point I want to bring up in this section: the uniquely screwed state of the UK’s debt.

First of all, one-quarter of British debt (called gilts) is inflation-linked. It should be noted that this is not CPI inflation (consumer goods), but rather RPI inflation (retail price index) which includes mortgage interest and council tax (meaning it tends to be higher). This is obviously bad in a country where 10% of the budget already goes to debt interest (with that set to spike in the years to come due to COVID borrowing hitting properly).

In other words: the UK government really needs inflation to not spike, as spiking inflation would mean spiking debt repayment costs. The primary lever that governments (not literal governments, but central bank boards but this doesn’t matter right now) have to pull when it comes to inflation is interest rates; higher interest rates make borrowing more expensive for households and businesses - thereby reducing expenditure and thus the price of goods (supply and demand). There’s one small problem though, what is that?

Well, back during COVID the UK decided to do a wee bit of what’s called ‘Quantitative Easing.’ Now for those of you who don’t know what this is (don’t worry, most don’t), think of it like the central bank making ‘digital dollars’ (or in this case, pounds) that are then used to buy government bonds. This allows the government to push more money into the economy - stimulating demand and keeping things running.

Now COVID was very nasty for the economy, of course, so the UK government did a LOT of quantitative easing. But there’s just one nasty little problem: you see, when the Bank of England created those ‘digital dollars’ they did so by crediting commercial banks with new reserves. And those new reserves? While the central bank pays interest on them, interest that is set at the base rate (the rate at which the BoE loans to commercial banks, which determines the rate at which money is lent throughout the economy). When base rates were very low during COVID (~0% in many nations), this wasn’t a big deal! But now that base rates are high (~5%) because the UK government wants to control inflation, all of a sudden, those reserve ‘digital dollars’ are VERY expensive.

So in other words: the UK government needs to control inflation because of the debt (and for general economic health reasons). But the harder it tries to control inflation, the more it has to pay to cover its reserves (which presently sit at north of 700 billion pounds)! This is all in a nation with nil economic growth, that is already running a significant deficit, and with a massive set of other problems I will discuss below.

If you don’t really get what I mean let me summarize it for you: hahahahahahahahahhaha, hahahahah, lol, hahahaha, fuck you, it’s so fucked. it’s really bad man. hahahahahahhaahha.

You can also read C.A. Bond for some more material on this.

Anyway,

The Sociopolitical Angle

If you find my account on ‘right-wing’ twitter, then you are probably already roughly familiar with how uniquely fucked the UK is in regard to immigration. This is a nation that received well in excess of 1% of its population for several years straight during the ‘Boriswave’, and that continues to grapple with a massive illegal immigration problem from ‘small boats’ coming across from Northern France. This is a nation where tens (hundreds?) of thousands of white girls were systematically sexually exploited by gangs of Mirpuri Pakistanis, a series of acts which were then covered up by the police and local politicians in many cases. This is a nation where a uniquely violent street gang culture spawned by a conflux of African and Arab migrants with American ‘rap’ culture has taken on a major global presence.

Like many other parts of this essay, I could write about the ‘problems’ leading up to it for hours, chronicling every bizarre intricacy that has led up to this point, but really my main point is this: the pigeons have come home to roost, and now the population of the UK has grown radically divided amongst political and racial lines because of this influx.

For several months now, ongoing protests have risen up organically in response to spates of sex crimes being carried out by freshly arrived migrants being stored in hotels while the central government figures out what to do with them. This all comes after last year’s spate of intense rioting that led to over a thousand arrests and the Ballymena riots in Northern Ireland earlier this summer. Immigration is now the number one concern of UK voters. Reform is set to win the next election quite significantly. Overall, people are dissatisfied and fed up with the state of the nation, just in general, but with immigration representing a particular flashpoint politically.

The consequence of the particular demographics the UK has imported are now also quite obvious: Jeremy Corbyn and Zarah Sultana have recently announced the formation of a new, left-wing populist party. This party will almost surely treat the Israel/Palestine debate as a matter of the highest importance and will likely rout labor from the urban-core districts populated by Muslim migrants of various stripes that it has traditionally held in many cities. The bleak prospect of a Green-Islamist left coalition now looks to be arriving quickly, with repercussions for the nation that I would rather not speculate on.

Circling back to more economic issues (but with a social lense), upward mobility in the UK is now all but destroyed outside of the confines of London. A massive wealth gap between the North and South of the UK continues to widen, while wealth inequality itself is also growing quite quickly. High inflation continues to eat into the financial wellbeing of the broad middle-class. Housing costs, in particular, continue to rise with few signs of slowing.

The Nicholas, 30 years meme has achieved its full zenith in the form of a government wholeheartedly dedicated towards handing out immense quantities of fiscal support to the lowest common denominator - including freshly arrived illegal migrants, all the while taxing and regulating the real economic base of the nation to hell.

And all the while who’s in charge?

The UK state bureaucracy is in disarray. The OBR - the ‘independent’ fiscal watchdog that’s supposed to sound alarm bells about the things I discussed earlier - is a wreck that can’t report on time and that does little but continually cover for the immigration regime by making erroneous claims about ‘ideal’ migrants. Meanwhile, the Whitehall bureaucracy is seemingly far more concerned with covering up the mass-importation of a bunch of Afghans than, well, seemingly anything else.

Very broadly, the general ‘social coherence’ of the UK can only be described in bleak terms. Institutional trust is all but gone, and the very real prospect of explosive political violence now exists in the public’s imagination. The bureaucratic class seem totally incapable of solving any of this. In the face of these challenges, who rises to meet them?

Surely not labor, who’s disastrous fumbling has only incited these problems even more.

Reform then? It doesn’t seem like it. Farage remains an awkward fumbler who some describe as a sellout due to his refusal to hold to mass deportations and questionable proposals for continued migration in certain sectors.

The Conservatives (despite the hopes of some) seem to continue to trot down the path towards irrelevancy. Their leader, a black Nigerian woman, has not exactly painted a compelling story of how they will fix the nation.

Ultimately, even with the financial issues in play. Even with the massive partisan polarization and the rise of radical left-wing elements. Even with a nation that seems locked into a very nasty downward slope, I think that this is the key problem: the UK is a rudderless nation. It’s not that there’s no one with a bold vision of ‘reform’ - it’s that there is no vision period. No one in the major parties and very few presently in government seem to have the slightest grasp of what is coming for them.

So what is coming exactly?

Putting the Pieces Together

I’ve written this article to try to collate the information I’ve gathered on the present state of the UK as an American observer. I am someone who, I like to believe, generally avoids the hysteric tendencies that are so common to online politics. That being said, it is very difficult for me to look at the situation I have laid out for you above and not be deeply perturbed.

I do not know what is going to happen in the United Kingdom in the next few years, but I am very confident that the present system will not last. Something will surely give, and when it does each piece of the situation I have just laid out for you will metastasize in rapid fashion, throwing one of the most clownish and intolerable political castes that presently exist anywhere on the planet into a nightmarish situation that far more competent men would barely be able to navigate successfully.

This all being said, with the magnitude of the rot laid bare it is almost impossible to not be bullish in a certain sense. If the core Anglo-Saxon population of the UK can last this long under such degraded and perverse conditions, if they can maintain a functional society in the face of such dysfunction, then it is hard to imagine what they will be able to do once the boot is taken off their necks.

Anyway, that’s all I got. Until next time: stay safe physically and cognitively, and do not ever fucking give up.

Mr Star

Subscribe to this btw, my twitter too.

I was introduced to this Substack by Sean Thomas, who references it in his article "Rue Britannia: America's Obsession With British Decline" for the UK current affairs magazine The Spectator.

You write that there seems to be "no vision" to the future of the country. This is actually wrong - there is a vision, but it is one that is hostile to the UK.

The UK is led by a political class that hates its own country. I don't mean this as your usual party-political rabble-rousing, but it is literally, objectively true.

George Orwell wrote about how English socialism was peculiar in its allergy to patriotism, that a right-on sort would rather be caught stealing from the donation box for poor relief than standing for the national anthem, and little has changed in the intervening century. Gus O'Donnell, the Cabinet Secretary (head of the British Civil Service) 2005-11, publicly stated "I think it's my job to maximise global welfare not national welfare" - the man who effectively runs the country, actively seeking to impoverish it. I also recommend that you look up the concept of "managed decline" - it was the educated, sophisticated, metropolitan opinion of the post-war consensus that Britain's time in the sun had passed and it was the duty of the Sensible, Mature, Correct people of the Establishment to make an orderly smooth transition and gently guide us down the path of dismantling Britain as a sovereign entity to be subsumed into a European superstate, like a hospice nurse encouraging the dying man to walk into the light, gradually enough that the lower orders didn't notice their country was being stolen from them and cause an unseemly amount of inefficient disruption to prolong the process. British politicians don't really have any interest in national government and only see it as a tedious ritual until they can qualify for a job-for-life on an EU or international legal committee somewhere. It's only gotten worse with the rise of wokery and we have a new generation of self-loathing activists who are consumed by post-colonial guilt and believe that Britain must be punished for the collective guilt of the inherited sins of empire. On the other side of the social scale, there is a pompous, arch contempt for "showy" patriotism - waving a flag is so terribly declassé, darling.

Our political class is a toxic mix of deranged "Imagine" utopianists, bean-counting accountants who only see immigration as Make Big Number Go Up More and have zero intelligence about its social costs, and bureaucratic jobsworths who only care about their pension. None of them prioritise the nation.

From an Englishman, this is insightful and almost entirely correct essay. I would take issue with Conservative leader being called a "black Nigerian" as if that's the most important thing about her. In fact, she's a great example of how immigration *should* work (not that this fact makes her the best leader of the Tories, or the country).

But aside from a couple of small things, the diagnosis is terrifyingly accurate, and civil war of some sort is inevitable. I imagine it'll start with citizens coalescing into gangs, targeting opponents' businesses, cultural and religious centres; street violence, squalid murders, that whole Northern Ireland 1969-1997 vibe, but even more insanely complicated.